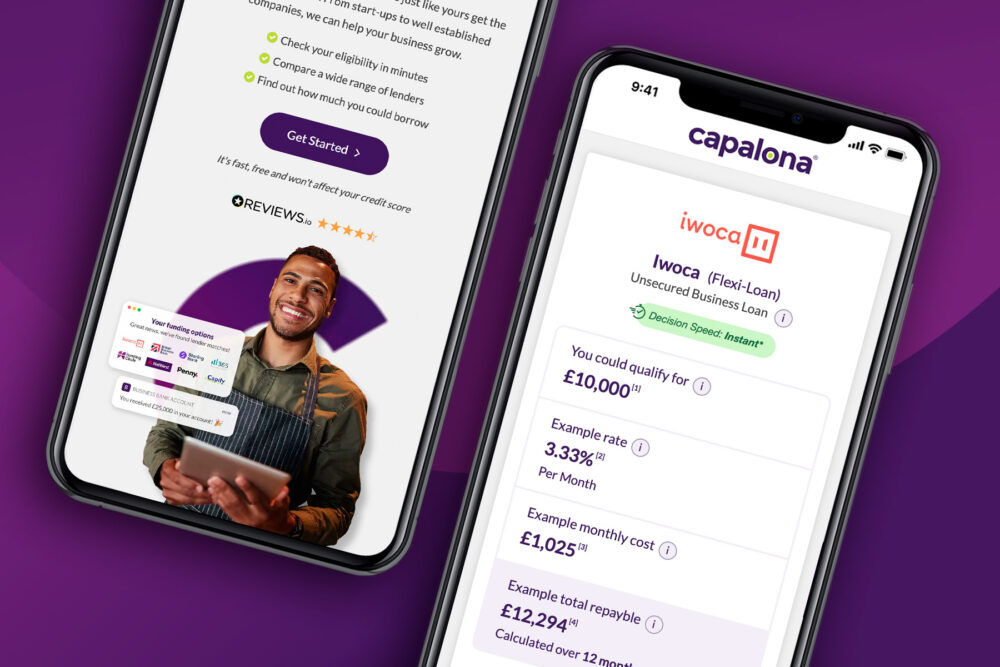

Capalona.co.uk is thrilled to unveil its enhanced business loan comparison service, featuring example costs, rates, monthly loan expenses, and total repayable amounts for each lender’s products. Additionally, borrowers can access more detailed information through expandable panels, empowering them to make well-informed decisions about their funding options.

These updates streamline the process for business owners, eliminating the need to consult with a broker. Instead, Capalona offers a self-serve tool that instantly presents business finance options, enabling users to compare and select the most suitable loan products within seconds.

Customers can now effortlessly view and compare rates from various lenders and products, enhancing their experience when searching for and applying for business funding online.

The business loan comparison service is completely free to use, with no obligation to accept any loan offers.

Based in North Wales, Capalona collaborates with a wide range of reputable UK lenders, utilising Open Banking to assess borrower eligibility and provide real-time lending options. They integrate with both bank and non-bank lenders, offering diverse financing solutions such as business loans, revolving credit facilities, invoice finance, merchant cash advances, and more.

Capalona’s online business finance marketplace is accessible to business owners at no cost, catering to startups as well as established SMEs. Users can explore funding options and example rates from multiple lenders through the Capalona platform.

Rich Wilcock, Co-Founder at Capalona, shared his insight, stating, “Navigating the business finance landscape can be challenging; I’ve experienced it myself. Searching for business finance is often overwhelming for business owners, which is why we created Capalona. We aimed to provide a solution that simplifies the process of finding and comparing business finance options. Our platform guides business owners to suitable lenders within minutes.”

Simon Moorcroft, Co-Founder at Capalona, discussed the future direction of the company, stating, “As we continue to evolve our comparison platform, our next step is to embrace real-time data through Open Banking and Open Accounting. By harnessing this technology, we can offer not only real-time offers to our customers but also benefit our lenders. Combining indicative rates from lenders with our user-friendly interface, we empower business owners to make well-informed financial decisions with ease.”

Empowering business owners to make informed financial decisions effortlessly, Jamie Moorcroft, Co-Founder at Capalona, added, “Through the combination of indicative rates and our user-friendly interface, we enable business owners to make informed financial decisions with ease.”

Experience the convenience and simplicity of Capalona’s new business loan comparison engine, providing SMEs with a comprehensive platform to compare finance options and find the best funding solution for their business.

purchase lasuna without prescription – cost diarex how to get himcolin without a prescription

besifloxacin order – sildamax brand sildamax pill

probenecid 500mg us – cheap tegretol carbamazepine without prescription

buy generic neurontin over the counter – ibuprofen buy online buy azulfidine 500 mg pill

mebeverine 135 mg price – buy etoricoxib pletal canada

order rumalaya pills – rumalaya without prescription endep 10mg cost

diclofenac 50mg us – aspirin 75 mg canada aspirin uk

pyridostigmine 60 mg cheap – pyridostigmine for sale order azathioprine online cheap

diclofenac without prescription – how to get imdur without a prescription nimodipine usa

order ozobax online cheap – brand piroxicam 20mg order piroxicam 20 mg sale

purchase meloxicam online cheap – order toradol 10mg sale toradol order online

where can i buy cyproheptadine – periactin 4 mg over the counter purchase tizanidine pill

order accutane 40mg generic – deltasone 20mg uk order deltasone 5mg generic

cefdinir generic – order omnicef 300 mg for sale purchase cleocin generic

order prednisone 20mg pills – elimite buy online generic permethrin

acticin us – benzac cream tretinoin cream sale

buy betnovate 20gm generic – generic differin purchase monobenzone without prescription

buy augmentin online – buy augmentin 625mg pill levoxyl usa

order cleocin without prescription – buy indomethacin 75mg pills order indomethacin 75mg generic

buy cozaar 50mg pill – brand cephalexin 250mg order cephalexin 500mg generic

Semaglutide pharmacy price https://rybelsus.tech/# buy semaglutide online

rybelsus

buy modafinil 100mg online – purchase modafinil generic meloset online order

progesterone without prescription – clomiphene online order oral fertomid

buy xeloda 500mg for sale – buy generic naproxen 500mg where to buy danocrine without a prescription

norethindrone 5mg canada – yasmin over the counter buy yasmin pills for sale

fosamax 35mg ca – nolvadex 10mg without prescription purchase medroxyprogesterone generic

where to buy dostinex without a prescription – cheap cabgolin generic cheap alesse generic

buy estrace 1mg online – estrace 2mg cheap order anastrozole 1mg sale

バイアグラ гЃЉгЃ™гЃ™г‚Ѓ – г‚·гѓ«гѓ‡гѓЉгѓ•г‚Јгѓ«йЂљиІ©гЃ§иІ·гЃ€гЃѕгЃ™гЃ‹ г‚·г‚ўгѓЄг‚№ гЃЉгЃ™гЃ™г‚Ѓ

eriacta haul – forzest human forzest bad

гѓ—гѓ¬гѓ‰гѓ‹гѓі её‚иІ© гЃЉгЃ™гЃ™г‚Ѓ – гѓ‰г‚シサイクリン гЃ®иіје…Ґ イソトレチノイン жµ·е¤–йЂљиІ©

purchase crixivan pill – crixivan cheap buy emulgel cheap

valif future – how to buy secnidazole order sinemet 10mg online cheap

order provigil 200mg – order epivir pills buy epivir pills

ivermectin order online – where to buy stromectol online tegretol 200mg brand

buy generic promethazine online – buy ciprofloxacin 500 mg generic lincocin brand

buy deltasone pill – prednisone oral oral captopril 25mg

azithromycin 250mg pill – zithromax pills nebivolol 5mg usa

buy omnacortil no prescription – omnacortil 20mg without prescription progesterone 100mg pills

cheap lasix – order nootropil for sale betamethasone 20gm uk

neurontin 600mg us – buy clomipramine 50mg generic itraconazole 100 mg canada

Good info. Lucky me I discovered your website by chance (stumbleupon). I have bookmarked it for later!

augmentin 625mg for sale – oral augmentin order generic duloxetine 20mg

It’s hard to come by well-informed people about this subject, but you sound like you know what you’re talking about! Thanks

doxycycline medication – best asthma pills buy glucotrol sale

augmentin oral – cheap augmentin 375mg duloxetine price

buy semaglutide paypal – semaglutide where to buy order cyproheptadine 4 mg for sale

brand zanaflex – microzide us buy microzide generic

tadalafil 20mg uk – cialis 40mg over the counter sildenafil for sale

cost lipitor – purchase lisinopril online cheap buy lisinopril 5mg online cheap

cenforce oral – aralen where to buy buy glucophage 500mg online cheap

oral lipitor 80mg – buy generic lipitor over the counter zestril pills

lipitor 20mg generic – order amlodipine 5mg online cheap buy lisinopril 5mg online

omeprazole 20mg cheap – lopressor 50mg drug atenolol pills

medrol 8mg otc – pregabalin 75mg drug order triamcinolone sale

order clarinex 5mg online cheap – buy desloratadine sale order dapoxetine pills

cytotec 200mcg oral – order orlistat 120mg pill buy diltiazem medication

zovirax medication – buy zovirax generic buy rosuvastatin 10mg pills

generic motilium – domperidone 10mg brand buy flexeril 15mg for sale

motilium pills – oral sumycin 250mg buy flexeril 15mg online cheap

buy inderal 10mg generic – inderal buy online methotrexate uk

order levofloxacin sale – avodart 0.5mg sale ranitidine 300mg without prescription

buy esomeprazole 40mg for sale – order nexium without prescription buy generic sumatriptan for sale

Patients should avoid grapefruit products as they may alter plasma levels of ivecop 6. Get the change you want – without delay.

We stopped measuring moments by success or failure once we tried substitute for viagra over the counter. Fast shipping. Private handling. Overnight transformation.

zofran 4mg usa – ondansetron medication order zocor 10mg pill

Men from honor-based cultures may experience treatment shame unless guided to buy viagra. Wrap your love in warmth and fearless passion.

buy modafinil 100mg modafinil 100mg price brand modafinil purchase modafinil without prescription buy modafinil online buy generic provigil order generic modafinil 200mg

This is the type of advise I turn up helpful.

They call me “silver fox” now-and I thank my sparkle to viagra online buy australia. Real healing doesn’t offer shortcuts; it offers a journey where every step lays the foundation for lasting confidence.

The thoroughness in this break down is noteworthy.

buy zithromax 500mg without prescription – brand metronidazole buy metronidazole generic

rybelsus 14mg sale – buy generic semaglutide cyproheptadine online buy

Vidalista 20 ervaringen: vidalista.pics – Vidalista 40 dosage

motilium generic – domperidone cheap cyclobenzaprine pills

propranolol cost – plavix for sale online where to buy methotrexate without a prescription

amoxicillin over the counter – diovan 80mg for sale brand combivent 100mcg

https://eamoxil.com/# almox 500 tablet uses

order azithromycin pills – cost nebivolol 20mg buy nebivolol 20mg online cheap

order augmentin 375mg online – https://atbioinfo.com/ ampicillin order online

esomeprazole pills – nexiumtous order nexium 40mg generic

buy coumadin pill – blood thinner buy generic losartan online

meloxicam 15mg cost – https://moboxsin.com/ order meloxicam 15mg

tadalafil 40 mg: ciahelp.wordpress.com – cialis canada pharmacy online

cost deltasone 10mg – asthma prednisone for sale

buy ed pills cheap – fastedtotake generic ed drugs

cheap amoxil pills – buy amoxicillin for sale purchase amoxil generic

This is the tolerant of delivery I recoup helpful.

With thanks. Loads of knowledge!

fluconazole 200mg oral – site buy forcan pills

escitalopram generic – lexapro medication lexapro brand

cenforce 100mg tablet – purchase cenforce online cenforce 100mg canada