You only need an hour a month to manage your finances.

Personal finance should be easy. After some initial work, automation should allow you to take a hands-off approach. And I mean hands-off literally. As in no touching your phone or computer to log in to a banking app to transfer funds every month. Most things personal-finance-wise should happen automatically.

6 Steps

How do you get there?

Unfortunately you can’t just click your fingers or wave your phoenix-feather-core wand or vigorously rub a lamp and all of a sudden you basically don’t check your finances anymore. It requires some upfront work:

- If you’re in (most types of) debt, work out how you’re going to pay off that debt.

- Audit your financial statements to see how much you currently spend.

- Determine significant areas of spending that you don’t care about and cut this spending ruthlessly.

- After this reduction, calculate how much you have left over from your income at the start of the month after a typical month of spending.

- Split this amount into short-term savings, goal-based/medium-term savings, and long-term investing.

- Set up automatic transfers and direct debits to pay your bills, followed by transfers to each of these savings/investing accounts, with the remaining balance being what you have to spend for that month.

80%

This up-front work, combined with an hour a month of monitoring accounts, will get you 80% there, which will put you in the top 5% of personal finance competency.

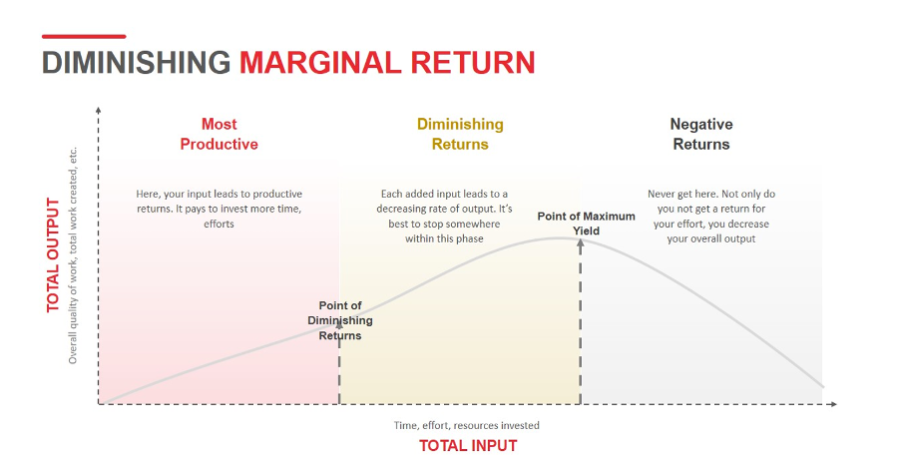

This is an example of the well-known idea that usually 80% of the results can be generated by 20% of the effort. This technique (the Pareto principle AKA the 80/20 rule) is a consequence of diminishing marginal returns. We identify a point at which extra effort is not worth the extra investment, and we stop there. The return on time spent simply isn’t appealing – remember, time is an investment, too.

Source: PowerSlides. Link: https://powerslides.com/product-tag/diminishing-marginal-return/

After this basic structure you can start to consider how (and why) to invest properly, how to save more by increasing income or further reducing expenditures, and other niche areas like taxes. Adding these components will get you to 95%.

The extra mile

The more astute of you may have noticed that this still leaves 5%.

“What about this last 5%?”, you may be asking, “How do I ‘complete’ personal finance and investing?”

It’s probably not worth your time to try.

Because markets, and planet Earth in general, are pretty efficient places. Finding some way to generate more money by doing something fancy is difficult, because most of these ways are already known about and exploited. You have to go all-in, medium commitment won’t cut it. In fact, medium could be worse than a low-effort approach.

Example: imagine you decide to start investing in options. A low-effort approach would be to simply, wisely, not do this. But you are, of course, different. You can use these financial instruments to generate extra returns. To do this profitably (without getting lucky) requires an edge – psychological, analytical, or informational. You really have to know what you’re doing. This requires a huge amount of time or intelligence or connections or something else exceptional.

Someone who doesn’t know what they’re doing but still participates has a medium-effort approach. They learn the basics about options. They learn the terms and how they work and how to trade them. But they don’t know enough – and subsequently lose their (size medium) shirt.

The low-effort person doesn’t trade and is hence neutral. The medium-effort person loses. The high-effort person wins. And if you think about time invested as a cost, it’s possible that the high-effort person loses, too.

This is why, if you’re going to attempt to generate excess returns, or find some type of tax loophole, or something else similarly fancy, you should probably be one of those freaks who actually takes pleasure in the activity. One of those weirdos who actually finds this stuff interesting and, maybe, God forbid, fun.

Pair this with a sensible approach to risk management. Initially only invest very small amounts, and even when you do feel confident – never bet the house.

Going after this final 5% can work. But I would seriously consider the time required to do so, as well as if you actually enjoy the process.

Leave a Reply